Bitcoin ANALYSIS:

The REAL reasons why big banking money is heading to crypto

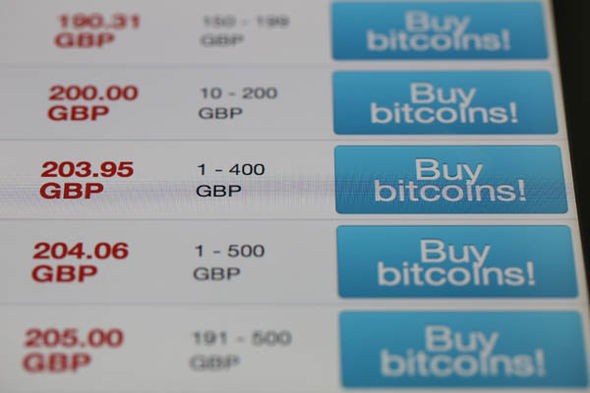

BITCOIN is enjoying another period of heady optimism and industry onlookers are now looking towards the next “explosion” that would send the price rising back towards $20,000.

With Bitcoin’sprice closing in again on $10,000, a number of commentators have championed the “institutional money flow” from banks, insurance companies, pensions and hedge funds that will help attract more “players” into the industry.One expert claims there are six big clues that are helping prop up this new-found optimism.

Andrew Pritchard of the Blockchain, 10X Growth Account told Express.co.uk the signals are: Bitcoin futures; the arrival of old money; backing from big banks like Barclays; interest from bigger banks like Goldman Sachs, new regulations and the lingering ‘fear of missing out’.

The arrival of banks and institutional money has been well documented. David Wills, COO and Co-Founder, Caspian told Express.co.uk that there is little doubt hedge funds, proprietary trading desks, Banks, VC funds and Family offices are all looking into crypto. He cites a recent Reuters survey pointing toward one in five institutions already actively looking into crypto investments.

Similarly, Marcus Swanepoel, Luno’s CEO and founder told Express.co.uk BTC could be the next gold. He said: “This is partly because of the similarities between some digital currencies, notably Bitcoin and gold: they’re both limited in supply, but both traded, understood and desired around the world.”

Serious traders merely see BTC as a wildly volatile instrument that threw up opportunities in an otherwise dull market. Mike Ingram, chief market strategist at WHIreland

Mike Ingram, chief market strategist at WHIreland

Support comes from the day-to-day workings of major capital market players with Mr Pritchard citing the potential cryptocurrency desk at Barclays. He said this “legitimises cryptocurrencies and shows institutional investment is coming to the table shortly”.

While Goldman Sachs has hired a VP of digital asset markets, Justin Schmidt, which Mr Pritchard said “demonstrates they are gearing up to start offering cryptocurrencies to their high net worth clients”.

Mr Pritchard told Express.co.uk that he is equally “optimistic” about reports of the arrival of George Soros into the cryptocurrency space.

On the arrival of ‘old’ money in the form of the Rockefeller family’s venture-capital arm “Venrock” partnership with CoinFund, John Frazer of DAV Foundation, told Investing.com: “If Soros is investing now, crypto will have met a list of criteria at his fund.

“This telegraphs that he feels there is significant profit to be made in the space.”

GETTY George Soros is reportedly planning to invest in crypto

Mr Pritchard also cites the unexpected rise in the trading of bitcoin futures at the The Chicago Board Options Exchange.

Futures are a type of contract that commits a buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument, at a predetermined future date and price. The finance world has warmed to the idea of futures as a way of bypassing short-term price volatility.

Bitcoin futures are less than six months old but Coindesk report the Chicago Board Options Exchange (CBOE) this week saw its highest-ever volume for bitcoin futures since it first debuted the contracts back in December. The breakdown saw 18,210 contacts for the May futures traded, along with 703 for the June contract and 87 for the July contract.

CBOE Options Institute senior instructor Kevin Davitt, said: “Yesterday was the highest daily volume for bitcoin futures since their introduction here at CBOE nearly five months ago.”

As bitcoin creeps towards the centre ground of global investment, Mr Davitt said that his firm will “be watching to see if this is a volume aberration or if more and more institutional types are moving into crypto”.

However, not everyone is convinced over the forthcoming arrival of institutional money in the crypto arena.

Mike Ingram, chief market strategist at WHIreland told Express.co.uk that the two markets are further away than many in the crypto community claim.

Mr Ingram said: “Serious traders merely see BTC as a wildly volatile instrument that threw up opportunities in an otherwise dull market.”

The strategist warns that for investors, cryptocurrencies are impossible to work with because they “defy any sensible attempt at fundamental valuation”.

He says that while they remain difficult or impossible to value ”they are just a punt.”

Original Post