Do Crypto Trading Bots Really Work?

Bots and talk of bots is endemic within the crypto space, with behavior, good and bad, often attributed to their actions. Mt Gox famously had the Willy Bot manipulating merrily, perennial bear Bitfinexed sees bots everywhere, and crypto traders are prone to boasting about the sick returns they’ve raked in from their proprietary arb bots. There’s no doubt that bot activity is very real. But is it profitable?

Got Bots?

In the 1950s, robots were promised that would soon eliminate the daily chores of housewives across the globe. 60 years later, and their cyber counterparts – bots – are promised that will do the same for crypto traders. If the hype is to be believed, these bundles of code can deliver a passive income for even the laziest or dumbest of traders. But as almost everyone knows, the hype is never to be believed. Profiting from bots isn’t that simple or easy.

There are several types of trading bots available including arbitrage (arb) bots that capitalize on the difference in prices across exchanges. The price of bitcoin usually differs from exchange to exchange; Bitstamp, for example, typically displays a slightly lower price than Bittrex. The movements of bitcoin and other cryptocurrencies is always mirrored across exchanges, however, so if BTC breaks out due to a massive buy order on Binance, you can bet that the other exchanges will follow suit. Bots work by profiting from the delay it takes for prices to update across all exchanges.

How Profitable Are Bots?

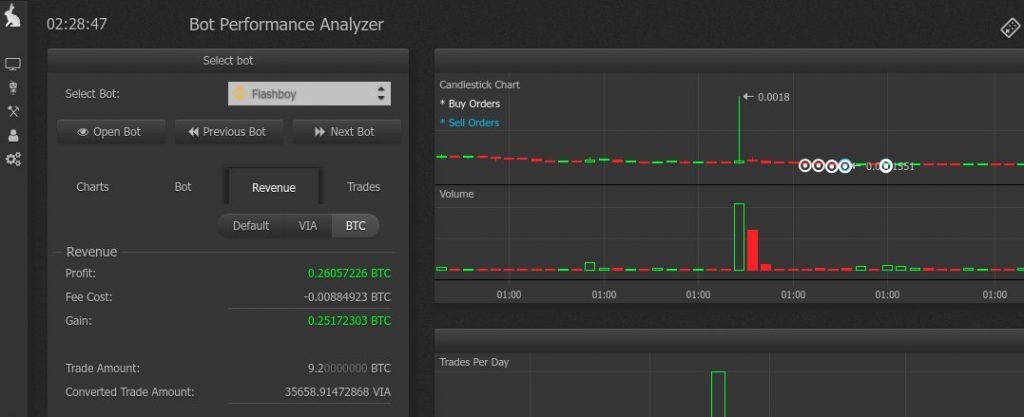

To make any sort of tangible profit from bot trading, you ideally need a stack of crypto to start with. If you’re running a bitcoin arb bot, for example, you’ll need BTC deposited on multiple exchanges that are connected to your bot via API. And even if you do have a healthy spread of coins, the returns can be slight. Romano – Viacoin developer and well-known crypto trader – claims the Hass bot he uses can make “0.26 BTC ($2K) a day by using 9 BTC for example just by using market inefficiencies” before adding that he doesn’t use the market maker bot that comes with Hass and cautioning that it’s “only for skilled traders”.

Arb trading can be likened to playing online poker. If you’re good at setting up your bots, you can make a living off it, but you’ve got to grind it out. Crypto trading bots are reminiscent of those money-making Forex programs that you find “veteran traders” trying to flog. If those Forex guys are as rich and successful as they profess to be, wouldn’t they be better served keeping that esoteric knowledge to themselves rather than offloading it to the masses for $100 a month? In other words, beware of geeks bearing bots.

Examples of Trading Bots

A slew of tokenized projects has emerged that promise “algorithmically-based smarter trading delivered via AI and machine learning” or words to that effect. These systems also utilize bots, but their claims of profitability have yet to be proven. If one of these new platforms were to deliver the goods and provide consistently high returns, crypto traders would flock to it, which simply hasn’t happened.

There is no doubt that machine learning has the potential to yield more profitable trading, but there is also no doubt that a lot of the claims attributed to AI should be filed under As If.

These are the most popular crypto bots on the market (and should only be tried at your own risk):

- Haasbot allows for automated trading across all major bitcoin exchanges, with monthly subscriptions starting from .073 BTC

- Profit Trailer allows you to average down on coins you buy into using bots, although there’s no guarantee that doing so will lead to eventual profit. It starts at $35 p/m

- Cryptohopper is a cloud-based trading bot that starts from $19 per month

- Gekko is free and open source but you need to tell it what to do and thus it’s only as smart as you are

- Cryptotrader also needs to be programmed and starts from .0048 BTC for a Pro account (Basic is cheaper but too basic)

Others, such as BTC Robot, are so spammy and scammy that we’re not even going to provide a link. For traders seeking a passive income or “easy money” there really is none to be had. The reality is that bots are trading tools rather than workhorses that will set up and execute winning trades on your behalf. In using bots, you also leave yourself open to the possibility of scammy developers or flash crashes, either of which can liquidate your crypto. As one redditor put it:

To see returns you have to be comfortably profitable already and be familiar with different strategies. The conditions for profitability are moving targets so bot trading isn’t really a ‘set it and forget it’ type of operation.

Bot or Not?

It is safe to say that the best bots are the ones you never hear about and will never be offered. Because if everyone was using these bots, the trading edge they bestow would be eliminated due to arbing and other opportunities being eliminated. If you’re interested in putting a trading bot to the test, by all means give it a try with some spare satoshis or shitcoins. Be sceptical though of anyone touting a bot delivering guaranteed returns, and be especially sceptical of the profits crypto traders claim to have made with their aid.

At least the creator of the open source Zenbot is honest enough to concede it “is having trouble reliably making profit. At this point, I would recommend against trading with large amounts until some of these issues can be worked out”.

Even if you can find a system that delivers modest returns, you may wish to ask yourself this: What would you rather have – a bot that can turn 5 BTC into 5.1 BTC every week or the freedom of having 5 BTC free to invest in a simple day trading strategy? Bots can do a lot, but as it stands, they can’t factor in fundamental analysis, breaking news, insider knowledge and the myriad other factors that make markets move.

1950s housewives (and house husbands) are still waiting on those domestic chore-performing robots to materialize. And similarly, we’ve still got some way to go before bots render human traders obsolete. If you want a job done profitably, do it yourself.

Have you had any success with crypto trading bots? Let us know in the comments section below.

Images courtesy of Shutterstock and Twitter.

Original Post